Degree of combined leverage measures a company’s sensitivity of net income to sales changes. Degree of operating leverage, or DOL, is a ratio designed to measure a company’s sensitivity of EBIT to changes in revenue. This means a 10% increase in sales would lead to a 26.7% increase in operating income. However, the downside case is where we can see the negative side of high DOL, as the operating when are credits negative in accounting chron com margin fell from 50% to 10% due to the decrease in units sold. In our example, we are going to assess a company with a high DOL under three different scenarios of units sold (the sales volume metric). If revenue increased, the benefit to operating margin would be greater, but if it were to decrease, the margins of the company could potentially face significant downward pressure.

Operating Leverage: Formula & Examples

Just like the 1st example we had for a company with high DOL, we can see the benefits of DOL from the margin expansion of 15.8% throughout the forecast period. Despite the significant drop-off in the number of units sold (10mm to 5mm) and the coinciding decrease in revenue, the company likely had few levers to pull to limit the damage to its margins. If a company has high operating leverage, each additional dollar of revenue can potentially be brought in at higher profits after the break-even point has been exceeded.

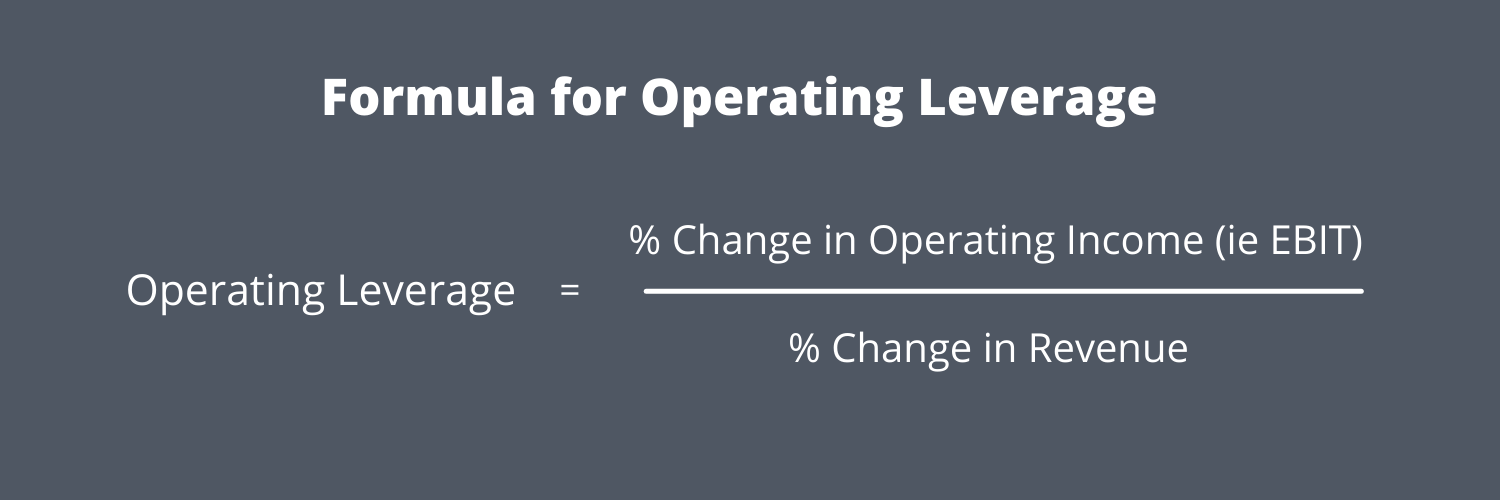

Formula for Operating Leverage

Higher measures of leverage mean that a company’s operating income is more sensitive to sales changes. Operating income is equal to sales minus variable costs and fixed costs. The DOL measures the how sensitive operating income (or EBIT) is to a change in sales revenue. In the table above, sales revenue increased by 10% ($62,500 to $68,750).

What is the approximate value of your cash savings and other investments?

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. These calculators are important because as critical as it is to know how the business is doing, the price you are paying for a part of the company is also important.

What Is the Difference Between DOL and Financial Leverage?

It is the ratio of the percentage change in operating income to the percentage change in units sold. The degree of operating leverage is an important indicator to measure the relative changes of earnings compare to changes in sales revenue by taking into account the proportion of fixed and variable operating costs. As you can see from the example above, when there are changes in the proportion of fixed and variable operating costs, the degree of operating leverage will change. ABC Co reduces its variable commission from $5 per unit to $4.5 per unit and instead increase the level of fixed operating costs from $2,500 to $3,000. These changes result in the increase of degree of operating leverage from 2 to 2.2. This formula is useful because you do not need in-depth knowledge of a company’s cost accounting, such as their fixed costs or variable costs per unit.

Investors Can Access The Risk

They need to have a strong marketing strategy to maintain the market share. It also exposes the risk of new competitors who are working for the same target customers. Undoubtedly, the degree of financial leverage can guide investors in investment decisions. Such businesses tend to have higher volatility of share prices and operating incomes in any economic catastrophe or change in demand pattern. By now, we have understood the concept of Dol, its calculation, and examples.

The company will struggle to increase its profit to meet the investor’s expectations. There are several different methods that can be used to analyze the company’s financial statements. The most common measures used by investors and third-party stakeholders are return on equity, price to earnings, and financial leverage. The return on equity is a good measure of profitability but does not take into account the amount of debt that the company has.

By analyzing DOL, stakeholders can better anticipate the impacts of sales fluctuations on a company’s profitability. Welcome to the fascinating world of the Degree of Operating Leverage (DOL)! If you’re eager to understand how changes in sales impact your operating income, you’re in the right place. This guide will walk you through the ins and outs of using the Degree of Operating Leverage Calculator, all while keeping things engaging and lighthearted.

In this best-case scenario of a company with a high DOL, earning outsized profits on each incremental sale becomes plausible, but this type of outcome is never guaranteed. If sales and customer demand turned out lower than anticipated, a high DOL company could end up in financial ruin over the long run. As a result, companies with high DOL and in a cyclical industry are required to hold more cash on hand in anticipation of a potential shortfall in liquidity. However, if revenue declines, the leverage can end up being detrimental to the margins of the company because the company is restricted in its ability to implement potential cost-cutting measures.

- The Operating Leverage measures the proportion of a company’s cost structure that consists of fixed costs rather than variable costs.

- Once obtained, the way to interpret it is by finding out how many times EBIT will be higher or lower as sales will increase or decrease respectively.

- On the other hand, low sales will not allow them to cover their fixed costs.

- Higher fixed costs lead to higher degrees of operating leverage; a higher degree of operating leverage creates added sensitivity to changes in revenue.

- If all goes as planned, the initial investment will be earned back eventually, and what remains is a high-margin company with recurring revenue.

However, it resulted in a 25% increase in operating income ($10,000 to $12,500). Revenue and variable costs are both impacted by the change in units sold since all three metrics are correlated. Therefore, each marginal unit is sold at a lesser cost, creating the potential for greater profitability since fixed costs such as rent and utilities remain the same regardless of output. After calculating the leverage by applying the formula, if the result is equal to 1, then the operating leverage indicates that there are no fixed costs, and the total cost is variable in nature. Once obtained, the way to interpret it is by finding out how many times EBIT will be higher or lower as sales will increase or decrease respectively. For example, for an operating leverage factor equal to 5, it means that if sales increase by 10%, EBIT will increase by 50%.

The DOL would be 2.0x, which implies that if revenue were to increase by 5.0%, operating income is anticipated to increase by 10.0%. Operating Leverage is controlled by purchasing or outsourcing some of the company’s processes or services instead of keeping it integral to the company. Another way to control this operational expense line item is to reduce unnecessary expenses, especially during slow seasons when sales are low. As a hypothetical example, say Company X has $500,000 in sales in year one and $600,000 in sales in year two. In year one, the company’s operating expenses were $150,000, while in year two, the operating expenses were $175,000.